Searching for Capable, Proven, Trustworthy Tax Relief Service? You Have Just Found It. Want to AVOID TAX RELIEF SCAMS? The Truth About That Is Here Too. Get Your TAX RELIEF PRAYERS ANSWERED, And Avoid Getting Ripped Off By Imposters.

Hello, I’m William McConnaughy, Tax Help Pro, Certified Public Accountant, Master Science Taxation, and a former IRS Revenue Agent.

With three decades in the tax relief industry, I’ve heard or seen just about every kind of bogus tax relief scheme — heartbreaking cases of even our most vulnerable citizens: the elderly, single parents, the infirm, young couples, and others — all being ripped off by heartless predators preying on anyone unfortunate enough to come into contact with them.

For this reason I have put up this website to educate consumers about the very real crimes being perpetrated against people just like yourself. Hundreds of thousands of people have lost millions of dollars to fly-by-night companies that prey on folks in serious need of tax relief services. I don’t want you to be next. Review the information presented below for your well-being and safety. Life changing tax relief is available here. Get your tax relief prayers answered today by reviewing and returning our guaranteed service contract.

Tax Scams/Consumer Alerts (IRS) (FTC)

Thousands of people have lost millions of dollars and their personal information to tax scams. Scammers use the regular mail, telephone, or email to set up individuals, businesses, payroll and tax professionals.

Learn About the Scams Targeting Taxpayers:

https://www.irs.gov/newsroom/tax-scams-consumer-alerts

Learn About Tax Relief Companies:

https://www.consumer.ftc.gov/articles/0137-tax-relief-companies

Researching Tax Relief Companies

If you’re researching tax relief companies I urge you to take note of the 15 red flags below signaling problematic tax relief firms that will only add to your tax troubles rather than relieving them.

The tax relief industry is littered with unqualified and/or unethical firms that will not hesitate to gouge you on fees and disappoint you with results or lack thereof. Don’t become one of their next victims.

Use this checklist to assist in your analysis & decision making.

Tax Relief Company – Selection Checklist |

||

McConnaughy CPA |

Competitor Firm |

|

| 1.) Soliciting prospective clients on pay per click review sites? | NO | |

| 2.) Company ownership verified? | YES | |

| 3.) Owner license verified? | YES | |

| 4.) Company physical location verified? | YES | |

| 5.) Professional experience verified? | YES | |

| 6.) Company history/longevity verified? | YES | |

| 7.) Double digit record of online complaints? | NO | |

| 8.) Unverified sales claims? | NO | |

| 9.) Use of expensive mass media advertising? | NO | |

| 10.) Excessive and/or open ended service fees to be charged? | NO | |

| 11.) Engages in telemarketing cold calling? | NO | |

| 12.) Money back satisfaction guarantee refund policy? | YES | |

| 13.) Confusing/bait and switch service contract? | NO | |

| 14.) Tax relief lead generation company? | NO | |

| 15.) High pressure sales tactics? | NO | |

| RED FLAG BONUS – Does the company utilize commission based sales people to solicit and close tax relief prospects? | NO | |

| Other factors to consider? | ||

| Did you speak with the person who will actually be representing you before the tax authorities? | YES | |

| Other unanswered concerns? | ASK ME | |

See explanation for each

RED FLAG below

(1) Use of misleading tax relief review, rating, or referral sites

Avoid these companies like the plague. These so-called “experts” will gladly send you and your information to some of the most notorious tax relief companies still open. Tax relief companies that have been successfully sued by state attorney generals for consumer fraud, tax relief companies that have literally hundreds of online complaints and negative reviews. Their ratings are given for your click. I have been approached to join some of these sites and instantly declined the invitation on the spot. I consider not being listed on them a badge of honor. See further information below about each and every one of these sites that have come to my attention.

(2) Anonymous company ownership

What kind of company does not want you to know who the owners are? There can be only one answer, and it is not a good one. I obviously believe in complete transparency with this website provided for your benefit.

(3) Unlicensed company ownership

If the company owners are not licensed, and highly experienced tax professionals, what business do they have operating a tax relief business? Would you believe some tax relief companies are owned by people with real estate, or consumer lending backgrounds, rather than being highly experienced tax relief pros? It’s true. All they have to do is hire someone with IRS practice rights to hold themselves out as a tax relief company. And IRS oversight of them is negligible. Which is why the industry is filled with unethical, under qualified operators. I am a licensed Certified Public Accountant, and have been doing this work as a focused niche service since 1992.

(4) Unlisted or virtual company location

Why do they not want you to know where they really are located? Again, there is no good answer to this question. You can find all of my contact information on the Contact page of this website. I have a real office where I can really meet face to face with any of my clients whether local or from out of town if and when the need arises.

(5) Unknown professional staff with unknown or unproven experience

Do you want just anybody handling this vital service for you? Don’t you want to know who is working for you? And their qualifications and track record in doing so? Don’t you think you deserve better service than a rookie, a cub attorney, or other bottom of the barrel help? Most tax relief companies employ people that are too inexperienced to have your life in their hands. I will tell you with the greatest degree of confidence what I can do for you, and be able to prove it with all tax relief case closure letters received from IRS and state tax agencies since 2012. There are literally thousands of them. See them yourself at www.taxhelp.pro/recent-cases/ or at www.theofferincompromisecpa.com/accepted-offers.php.

(6) No history

The company can not prove how long they have successfully been providing tax relief services. In my decades of experience I have seen literally hundreds of companies, big and small, rise and fall. Don’t take a chance with someone who plans on closing the doors and disconnecting the phones soon. They will not give your money back to you. I have been successfully self employed tax professional since 1990. And have done tax relief work since 1992.

(7) Complaint record

Even the best run and squeaky clean company can get a complaint on occasion due to an honest misunderstanding or an unreasonable client. A double digit number of complaints means trouble. Unethical or incompetent management. Or both. As previously mentioned, the largest tax relief companies have hundreds of online complaints, and that is just the tip of the iceberg. I may get one complaint in a decade, from an honest misunderstanding or unreasonable client. See examples here here here, and here.

(8) Meaningless sales puffery

Use of hot air to reel you in, such as…As Seen On TV, The Most Trusted, Nation’s Best, Most Credible, Industry Pioneer, blah, blah, blah. You have heard this stuff a million times, and take it with a grain of salt. I will only tell you what I know I can do for you, because I know I can do it for you and can prove I can do it for you. No need for hype here.

(9) Use of mass media (TV/radio) commercials

Guess who has to pay for this extra layer of business overhead packed with misrepresentations and outright lies? You do. You will not see me on TV or hear me on the radio for this good reason.

(10) Excessive fees

Any company wanting more than $5,000 for a full service representation engagement is ripping you off. Period. And they will gouge you for all they can since the person you are likely to speak with when you call them will be a commission paid salesperson. My fee schedule is fixed, flat, and fair. $2,500 to $4,955 depending on complexity of case, and amount of tax, interest, and penalty owed. Not one red cent more no matter what it takes to get you to the promised land.

(11) Cold calling

Having telemarketers make uninvited sales calls to your home or office. Need I say more? I have never engaged in this rude, intrusive type of marketing effort.

(12) What’s their refund policy?

If they can’t help you, do they give all your money back? Most reputable tax relief professionals have a full money back guarantee. I do as well and it is front and center, first paragraph of my guaranteed tax relief service contract.

(13) Bait and switch contracts

Bait and switch low initial fees. Use of cleverly worded contracts that make you think one thing, but end up meaning something very different. My service contract is very simple, straight forward, written in plain English, with no double talk or fine print. It only takes one minute to read it, sign it, and date it.

(14) Does the company talk about their “affiliates” or “associates”?

If so, they might be a lead generation company — which means they sell you and your personal information to the highest bidder, who may or may not be a qualified or ethical tax professional. Or maybe not a tax professional at all. I acquire all of my leads myself, with my own websites. I do not buy from lead wholesalers.

(15) High pressure sales tactics

Arm twisting, brow beating, and fear mongering are not the means by which real tax professionals will win your trust and business. If you are thinking about signing up with a company just so they will stop calling you all the time and stressing you out…watch out. If the so-called “Consultant” comes off to you like some kind of a pushy jerk, guess what. You’re on to them! You will never get this from me. I will typically do one follow up contact after an initial consultation is done. If the prospect does not want to get back to me I respect that choice, and just hope they do not go with one of the companies I tried to warn them about.

RED FLAG BONUS

Commission paid salespeople posing as “Tax Consultants” who will tell you anything you want to hear in order to convert you into a paying customer. I have secretly shopped ALL of my tax relief competitors and can tell you for a fact that these people do not know what they are talking about. Their “consultation” is almost always wrong and is dangerously detrimental to you best interests. Trust me on what I am telling you about these posers! They will promise you the moon. I will not. I will tell what is and is not possible. The best thing is I know a lot of possibilities since I have done a lot of tax relief cases in nearly thirty years of service.

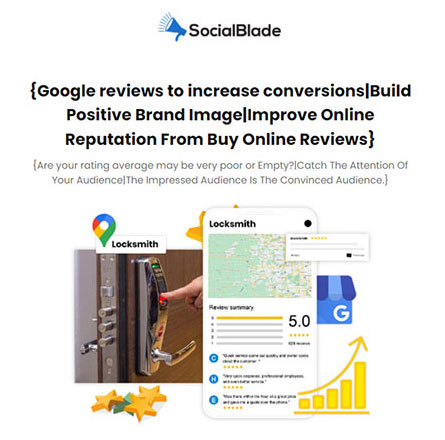

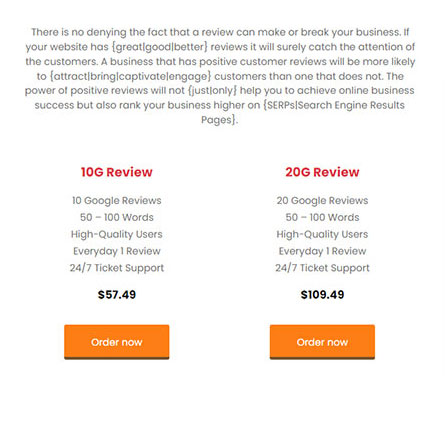

SocialBlade: Selling Online Reviews

One of the most outrageous examples of fraud I’ve found is SocialBlade’s monetization of Google Reviews. In their unsolicited email they note that they will help a business improve their online rating with the search engines by writing reviews. They go on to note that “There are a lot of factors that make us unique when you choose to buy reviews”. Well yes, they are unique. Few businesses are so blatant about their intention to deceive website visitors. Click the images adjacent to see their email.

Tax Relief Reviews

How To Spot A “Pay to Play” Click Traffic Website

https://www.wikihow.com/Spot-a-Fake-Review-Website

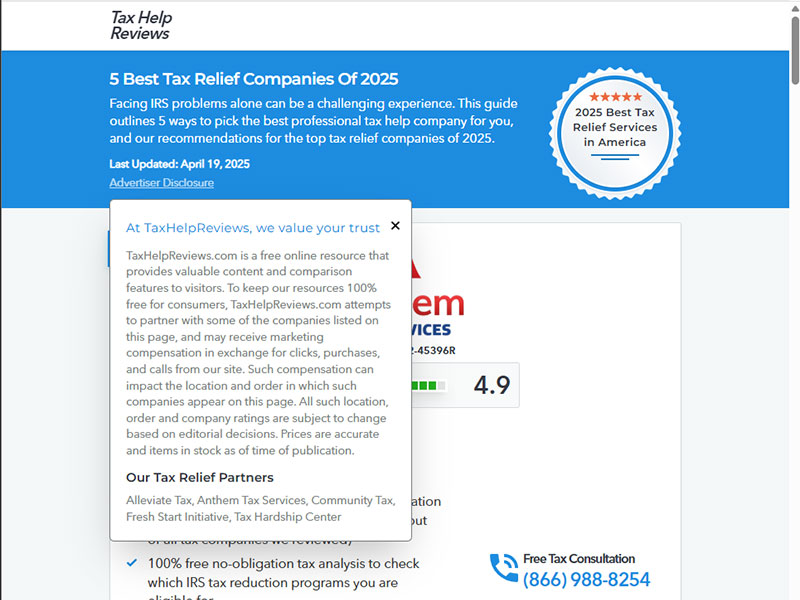

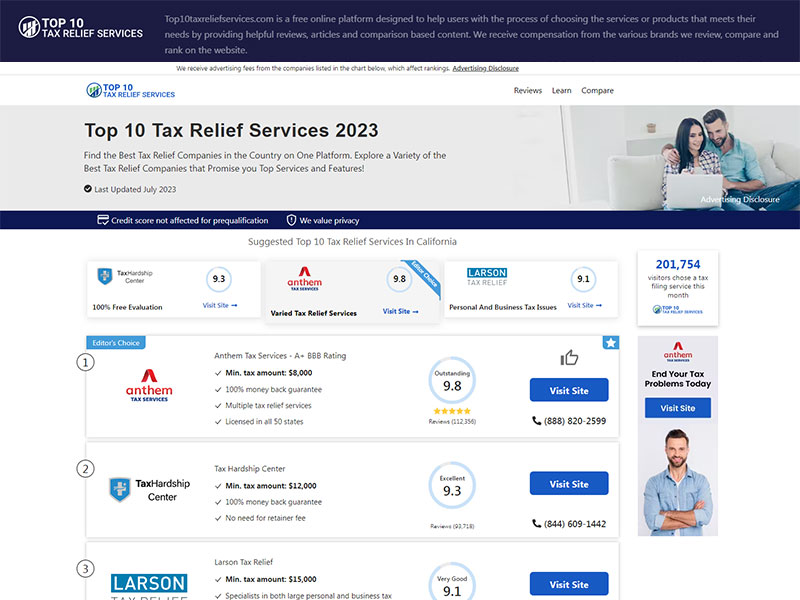

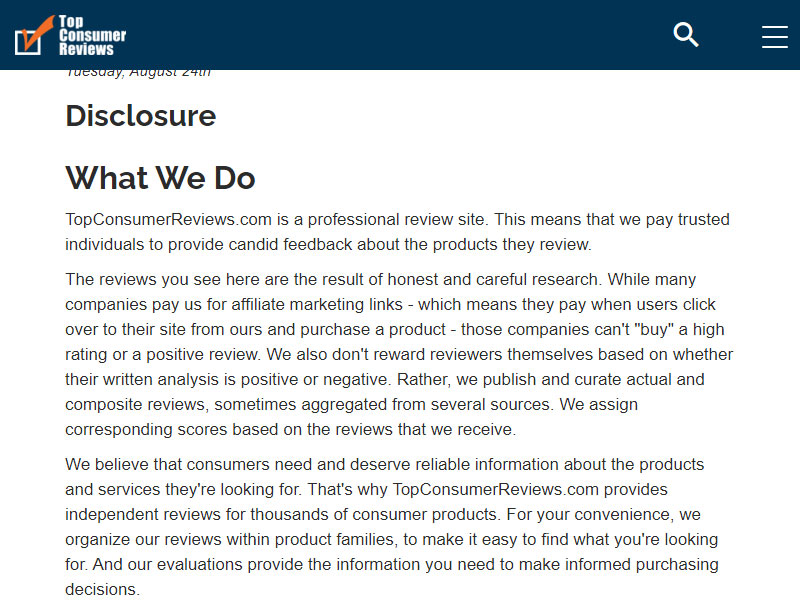

By law a company must disclose when they receive an advertising fee. Of these most every company has placed their legal disclaimer in a place not easily found, and in the wording most attempt to normalize and justify their practice. Keep in mind that a review can only be trusted when payment or receiving advertising dollars for inclusion is NOT a ranking factor.

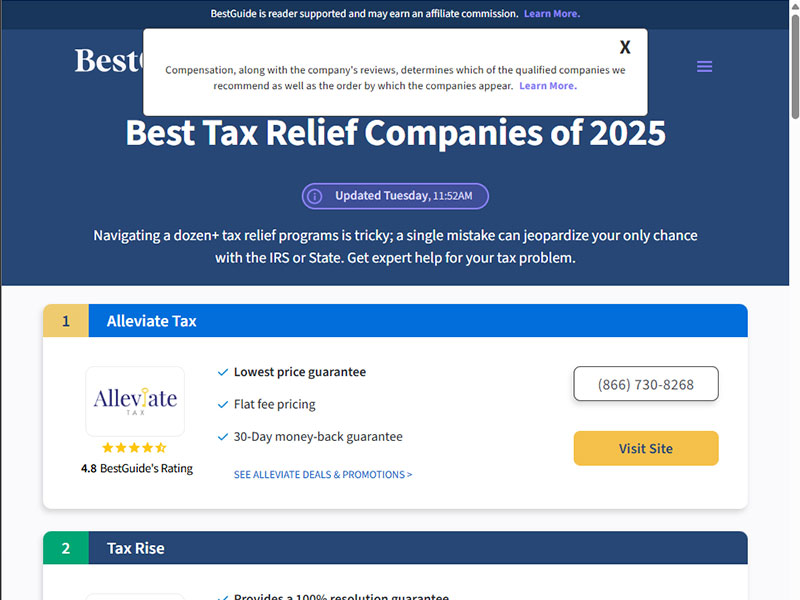

Best Guide

Compensation received for reviews.

View Website

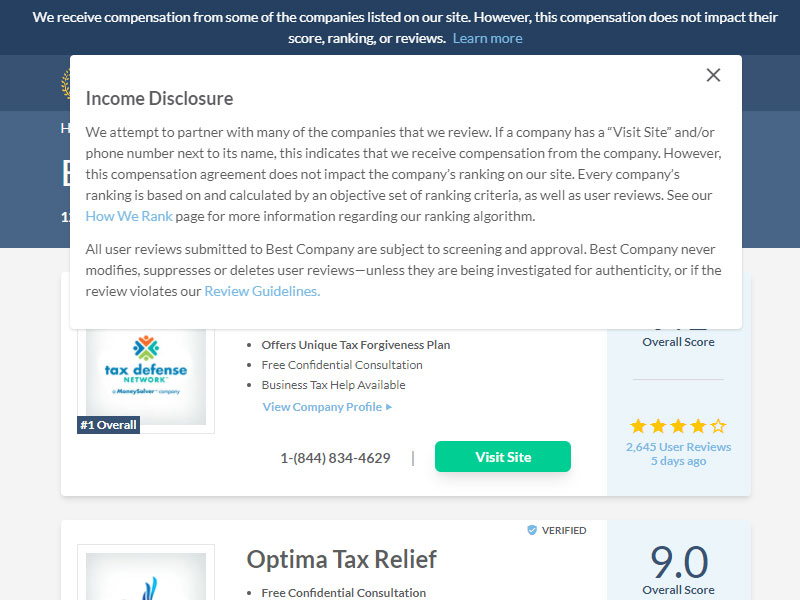

Best Company

Compensation received for review inclusion.

View Website

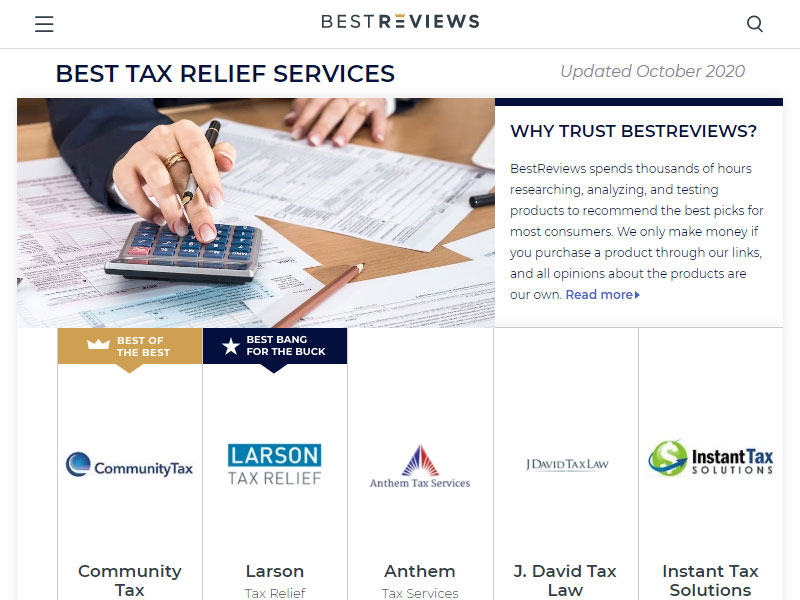

BestReviews

Payment recieved when purchases are made.

View Website

Best Tax Relief Services

Advertiser notice hidden. Supported by referral fees.

View Website

Business.com

Comission payments received for clicking review links.

View Website

BuyerZone

Advertisement payments received. No disclaimer.

View Website

Centsai

Payment received for recommendations.

View Website

Compare Tax Relief

Accept advertising compensation.

View Website

ConsumerAffairs

Compensation received — NOT to be confused with Consumer Reports.

View Website

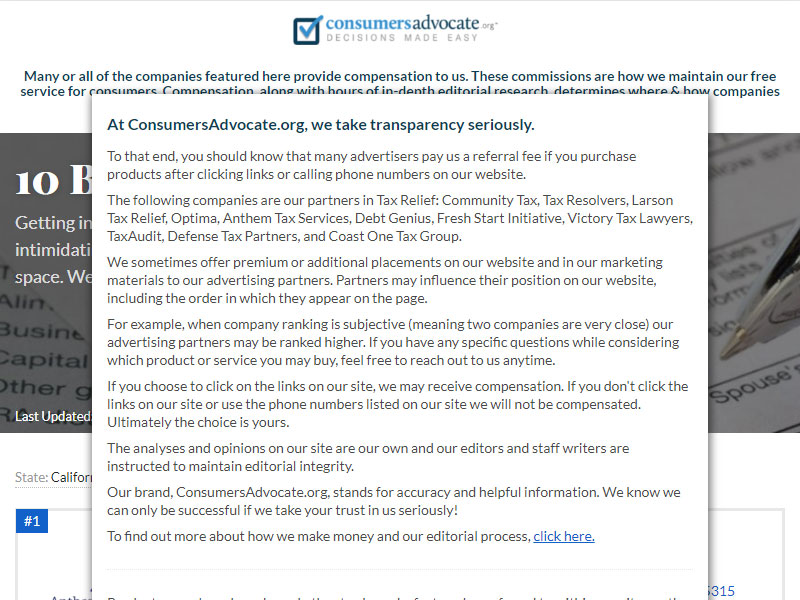

ConsumersAdvocate

Compensation for review inclusion.

View Website

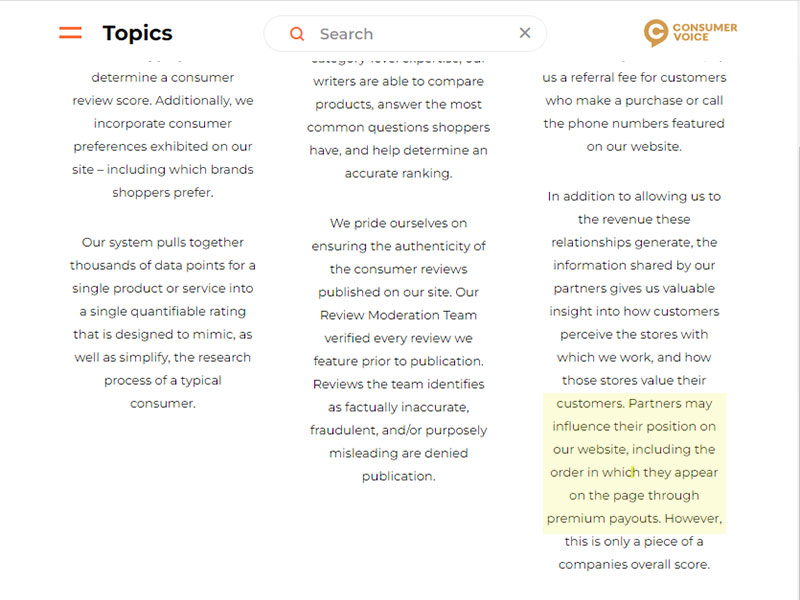

Consumer Voice

Advertising disclosure hidden. Position based on payment.

View Website

FinMasters

Commission received for purchases.

View Website

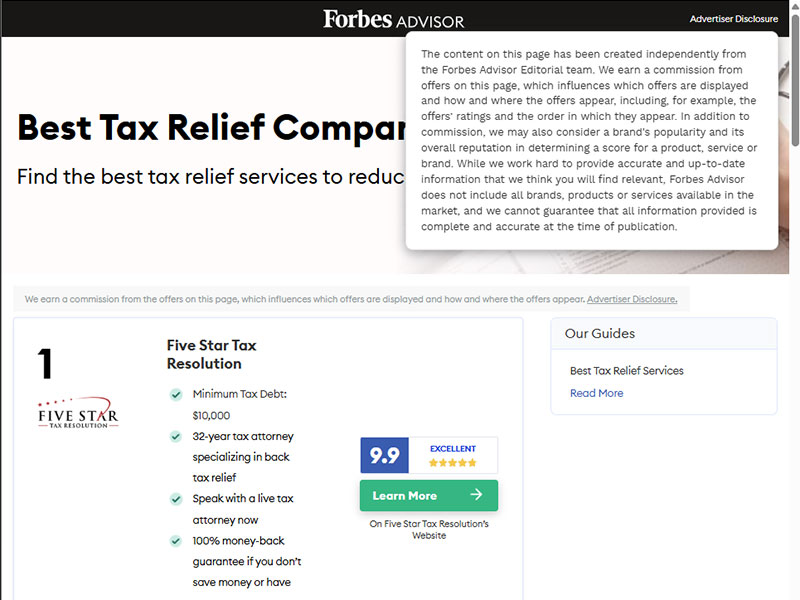

Forbes

Commission received from advertisers.

View Website

Good Financial Cents

Advertisement payment for review inclusion.

View Website

Investopedia

Advertisement payment for review inclusion.

View Website

LendStart

Advertisement payments received. Disclaimer hidden.

View Website

NerdWallet

Compensation received for review inclusion.

View Website

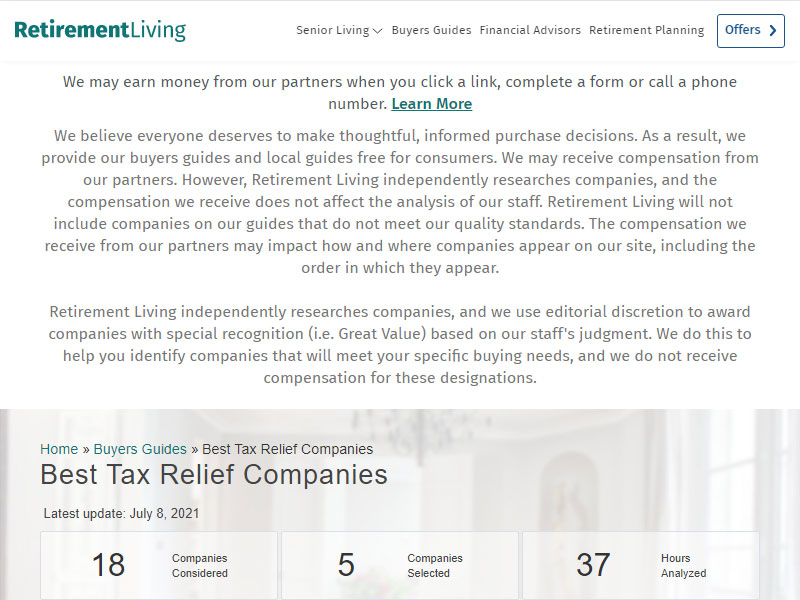

RetirementLiving

Payment received for clicking review links.

View Website

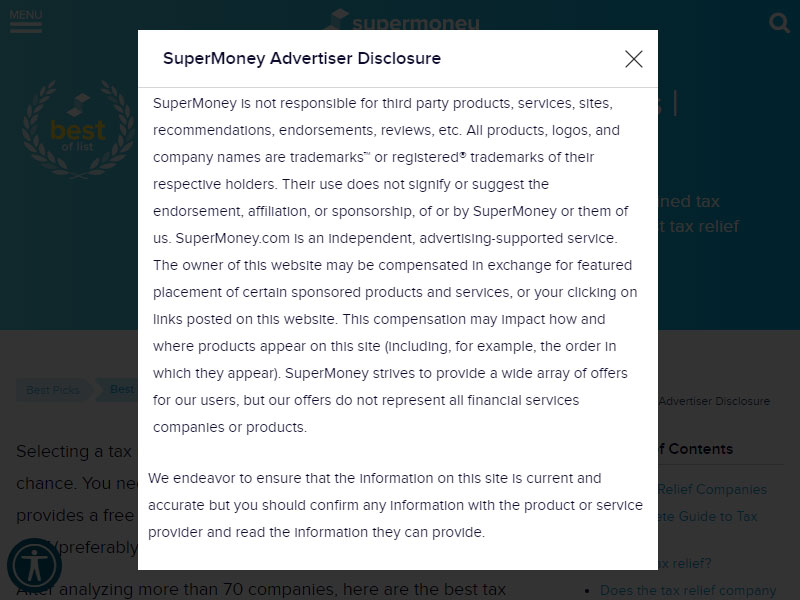

SuperMoney

Advertising supported review endorsements.

View Website

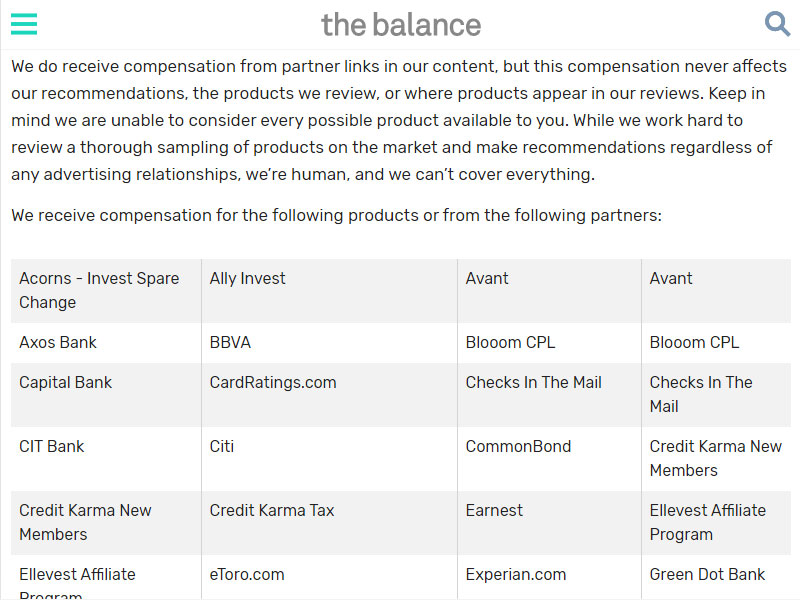

The Balance

Advertising supported reviews.

View Website

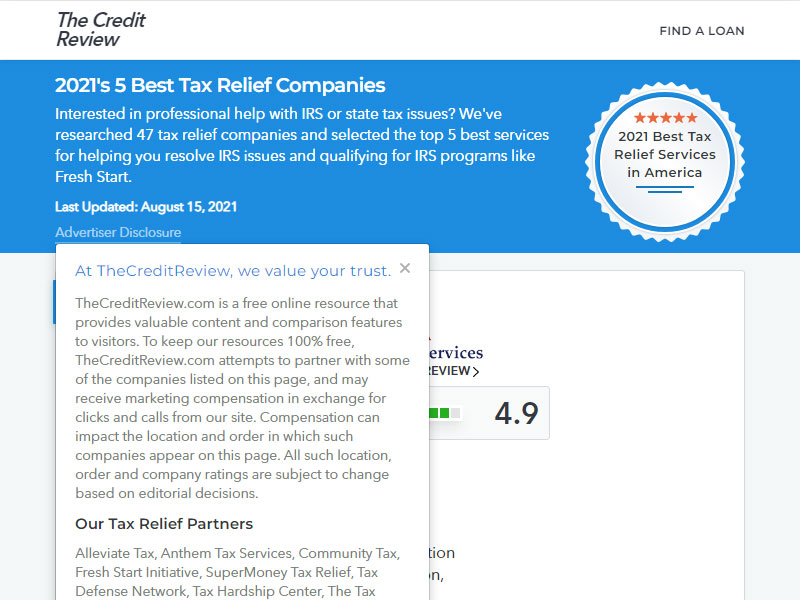

The Credit Review

Marketing compensation received for clicks/calls.

View Website

Tax Help Previews

Marketing compensation received.

View Website

Tax Help Reviews

Payment made in exchange for position, clicks, and calls.

View Website

Top 10 Tax Relief Services

Compensation received for reviews.

View Website

Top Consumer Reviews

Affiliate marketing link payments. Disclaimer hidden.

View Website

Tax Relief Fraud

News Reports on Prevalent Tax Relief Scams

Additional Information

The Truth About IRS Settlement Firms

The Massive Fraud Problem With Tax Relief Local Search

Do You Want the Best Tax Relief?

Your best tax relief is here!

BEST TAX RELIEF MEANS:

Guaranteed lowest tax settlement you qualify for,

Guaranteed lowest, most flexible service fees,

Guaranteed protection against levies,

Guaranteed lien releases,

Money back satisfaction guarantee,

Guaranteed one on one personal representation by me with you, to address and resolve your unique tax needs and circumstances.

Simply put; the best tax relief services to be found, period!

I guarantee you will be satisfied with my professional ability and ethical integrity. I guarantee I can prepare and file any prior year taxes for you, this year’s taxes for you for free, and next year’s taxes too if you want me to. And I guarantee to give you a free IRS and/or state tax status report along with a free IRS penalty abatement request. All this from a CPA who can also assist you with any accounting or financial assistance you may need. For free. It does not get any better than this.

William McConnaughy, CPA

Master of Taxation / Former IRS Revenue Agent

Please click on the video below for a personal message from me to you about my approach to client service. You will like what you see and hear.

See proof of what I am saying from the links that follow…see our Recent Case closure letters, our Recent Levy Releases, my CPA license lookup, Still skeptical? Call to receive an absolutely FREE IRS Status & Settlement Report detailing where you stand and what can be done in getting the best possible resolution of your tax situation, and FREE Bonus IRS Penalty Abatement Request.

If you want my help you can have your case started with no money down, be protected with a 30 day full refund guarantee, and cancel anytime you want. Enjoy guaranteed relief, levy protection, and our lowest fee guarantee. I want to make your path clear, and see you all the way to your tax relief destination.

Call us. Chat with us. Or send a request for help by email.

Contact me by phone or email now to get the truly

BEST TAX RELIEF you are looking for.

Find out how affordable and easy it is to benefit from our triple guaranteed (3X) service program today — 1) Best Results, 2) Lowest Fees, and 3) Levy Protection.

You have nothing to lose, and everything to gain.

Don’t gamble with your money, or your life, by going anywhere else for this critical service. Contact me today — and show the tax relief hustlers you’re too smart to fall for their schemes.

Guidance provided to secure fee refunds and bring tax relief scam companies to justice.

William D McConnaughy, CPA Offers Free Help to Tax Relief Scam Victims — CISION PR Newswire

– Read Article

Lowest Fee Guarantee — Take $395 Off Any Fee Quote Given To You By Any Tax Relief Company When You Become My Client.

William McConnaughy, Tax Help Pro

Certified Public Accountant

Master Science Taxation, Former IRS Revenue Agent

Email: williammcconnaughycpa@gmail.com

Toll free: (888) 225-1272 | Facsimile: (916) 979-7681

3550 Watt Ave Ste 140

Sacramento, CA, 95821-2666

– Websites –

backtaxeshelp.pro

offerincompromise.pro

file-past-taxes.com

tax-problem-solvers.pro

taxhelp.pro

Please BOOKMARK this site before leaving so that you can come back to it again easily!